- Before tax reform, you could deduct state and local property taxes, plus either state and local income taxes or sales tax. Now, your total deduction for state and local income tax is limited to $10,000 per income tax return ($5,000 if married filing separately).

- You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040 or 1040-SR) PDF and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return.

- He should report his gambling income of $10,000 on Form 1040, U.S. Individual Income Tax Return, and $10,000 of his wagering losses on Schedule A in both 2017 and 2018. If G is a professional gambler, he could claim an NOL of $9,500 from gambling activities in 2017, as shown in the chart.

Gambling wins are reported on Schedule 1, Line 21 for tax year 2018. All gambling wins are required to be reported even if the casino doesn't report the win to the IRS. Gambling wins are reported on a W-2G for: bingo or slot wins of $1,200 or more (not reduced by the wager).

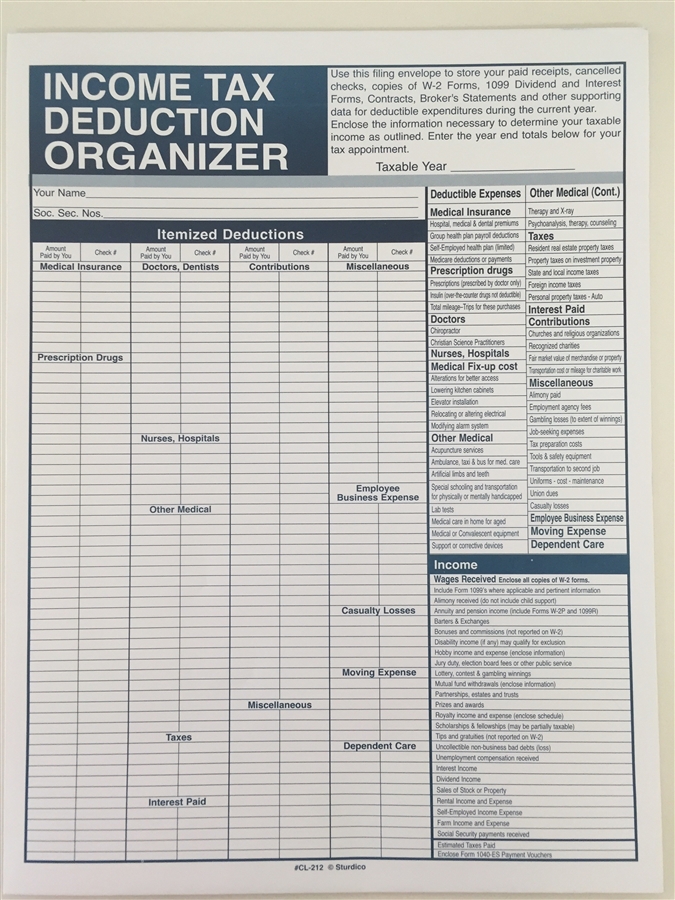

The passing of tax reform brought many eliminated tax deductions. To make the most of your 2018 tax year, it's important to understand the changes. You may want to make financial adjustments now to ensure your tax outcome is favorable.

Gambling Tax Deduction 2018 Filing

List of Eliminated Tax Deductions

Gambling Tax Deduction 2018 Limits

Take a look at these eliminated tax deductions to understand if they affect your situation and how you can handle it.

Moving expenses

You can no longer deduct moving expenses when you relocate for a job or for self-employment.

Action plan: Because moving expenses are part of the eliminated tax deductions, it's more important than ever to keep a lid on moving costs. For example, you may want to have shipping containers delivered to your door so you can load them yourself instead of hiring a full-service moving company to wrap every piece of glass. You'll also want to consider the pros and cons of moving more carefully before you agree to move for a transfer or new job.

Home equity loan interest

Starting in 2018, you cannot deduct interest on a home equity loan, unless you used the loan to buy, build, or significantly improve your home and the loan is secured by your home.

Action plan: Consider paying down home equity lines of credit (unless you have higher interest rate consumer debt you should pay off first). If you take out new home equity debt, make sure it meets the requirements to be deductible, if possible.

Personal exemptions

Gambling Tax Deduction 2018 Irs

For the 2018 tax year and beyond, you can no longer claim personal exemptions for yourself, your spouse, or your dependents. Previously, you could lower your taxable income by about $4,000 for each person in your household.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.03.26AM-e376b945aa4e4b7381f63b10e4de9cc2.png)

Action plan: Don't panic! For most people, other changes in the tax code should make up for the lack of a personal exemption. The standard deduction almost doubled for most tax filers. Plus the value of expanded credits for children and dependents improved as well.

Deductions for state and local taxes

Before tax reform, you could deduct state and local property taxes, plus either state and local income taxes or sales tax. Now, your total deduction for state and local income tax is limited to $10,000 per income tax return ($5,000 if married filing separately).

Action plan: Now more than ever, you should consider taking steps to limit your state and local tax burden. You won't want to pay property tax on real estate or personal property that you don't need or use, for example. You may want to look into ways to reduce your real estate taxes, such as open space designations or challenging your assessment.

Miscellaneous Itemized Deductions

On Schedule A, you can no longer claim all miscellaneous itemized deductions previously subject to a 2 percent floor. That includes:

Gambling Losses Tax Deductible 2018

- Before tax reform, you could deduct state and local property taxes, plus either state and local income taxes or sales tax. Now, your total deduction for state and local income tax is limited to $10,000 per income tax return ($5,000 if married filing separately).

- You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040 or 1040-SR) PDF and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return.

- He should report his gambling income of $10,000 on Form 1040, U.S. Individual Income Tax Return, and $10,000 of his wagering losses on Schedule A in both 2017 and 2018. If G is a professional gambler, he could claim an NOL of $9,500 from gambling activities in 2017, as shown in the chart.

Gambling wins are reported on Schedule 1, Line 21 for tax year 2018. All gambling wins are required to be reported even if the casino doesn't report the win to the IRS. Gambling wins are reported on a W-2G for: bingo or slot wins of $1,200 or more (not reduced by the wager).

The passing of tax reform brought many eliminated tax deductions. To make the most of your 2018 tax year, it's important to understand the changes. You may want to make financial adjustments now to ensure your tax outcome is favorable.

Gambling Tax Deduction 2018 Filing

List of Eliminated Tax Deductions

Gambling Tax Deduction 2018 Limits

Take a look at these eliminated tax deductions to understand if they affect your situation and how you can handle it.

Moving expenses

You can no longer deduct moving expenses when you relocate for a job or for self-employment.

Action plan: Because moving expenses are part of the eliminated tax deductions, it's more important than ever to keep a lid on moving costs. For example, you may want to have shipping containers delivered to your door so you can load them yourself instead of hiring a full-service moving company to wrap every piece of glass. You'll also want to consider the pros and cons of moving more carefully before you agree to move for a transfer or new job.

Home equity loan interest

Starting in 2018, you cannot deduct interest on a home equity loan, unless you used the loan to buy, build, or significantly improve your home and the loan is secured by your home.

Action plan: Consider paying down home equity lines of credit (unless you have higher interest rate consumer debt you should pay off first). If you take out new home equity debt, make sure it meets the requirements to be deductible, if possible.

Personal exemptions

Gambling Tax Deduction 2018 Irs

For the 2018 tax year and beyond, you can no longer claim personal exemptions for yourself, your spouse, or your dependents. Previously, you could lower your taxable income by about $4,000 for each person in your household.

Action plan: Don't panic! For most people, other changes in the tax code should make up for the lack of a personal exemption. The standard deduction almost doubled for most tax filers. Plus the value of expanded credits for children and dependents improved as well.

Deductions for state and local taxes

Before tax reform, you could deduct state and local property taxes, plus either state and local income taxes or sales tax. Now, your total deduction for state and local income tax is limited to $10,000 per income tax return ($5,000 if married filing separately).

Action plan: Now more than ever, you should consider taking steps to limit your state and local tax burden. You won't want to pay property tax on real estate or personal property that you don't need or use, for example. You may want to look into ways to reduce your real estate taxes, such as open space designations or challenging your assessment.

Miscellaneous Itemized Deductions

On Schedule A, you can no longer claim all miscellaneous itemized deductions previously subject to a 2 percent floor. That includes:

Gambling Losses Tax Deductible 2018

- Employee business expenses

- Tax preparation expenses

- Safe deposit box rental

- Investment fees

Gambling Tax Deduction 2018 Income Tax

Action plan: There's more incentive than ever to cut expenses when they are part of the list of eliminated tax deductions. For example, not everyone needs to rent a safe deposit box or pay a professional to prepare their taxes. (Hint: offers some DIY options.) If you have significant employment expenses, you can try to press your employer to reimburse those costs. Or, you can get creative and find out if you qualify as an independent contractor instead of as an employee. (Self-employed people can still deduct business expenses on Schedule C.)

Casualty and theft losses

You can no longer take a deduction for casualty or theft losses, except in places the president declares disaster areas.

Action plan: You can't avoid all potential for casualty losses, but you can make sure your homeowners or renters insurance is up to date and covers natural disasters. That includes floods and fires.

Alimony payments (2019)

You can no longer deduct alimony payments as a result of a divorce settled after 2018. That means the tax reform changes do not apply to settlements finalized before Jan. 1, 2019. If you receive alimony payments from a settlement in place from 2019 and forward, you won't pay tax on the alimony you receive.

Action plan: If you are in the midst of divorce proceedings, make sure the division of property and alimony payments reflects the new tax realities. Generally, the alimony payments can be smaller to compensate for the change in tax law.